library(tidyverse)

library(broom)

library(stargazer)

library(skimr)

library(DT)Linear Regression II

Orange Juice Data

R packages

Read_statusing a CSV File

df <- read_csv("https://bcdanl.github.io/data/dominick_oj_feat.csv")Variable description

| Variable | Description |

|---|---|

sales |

Quantity of OJ cartons sold |

price |

Price of OJ |

brand |

Brand of OJ |

ad_status |

ad_statusvertisement status |

Continuous variables

salesprice

Categorical variables

brandad_status

Exploratory Data Analysis

skim(df)| Name | df |

| Number of rows | 28947 |

| Number of columns | 4 |

| _______________________ | |

| Column type frequency: | |

| character | 2 |

| numeric | 2 |

| ________________________ | |

| Group variables | None |

Variable type: character

| skim_variable | n_missing | complete_rate | min | max | empty | n_unique | whitespace |

|---|---|---|---|---|---|---|---|

| brand | 0 | 1 | 9 | 11 | 0 | 3 | 0 |

| ad_status | 0 | 1 | 2 | 5 | 0 | 2 | 0 |

Variable type: numeric

| skim_variable | n_missing | complete_rate | mean | sd | p0 | p25 | p50 | p75 | p100 | hist |

|---|---|---|---|---|---|---|---|---|---|---|

| sales | 0 | 1 | 17312.21 | 27477.66 | 64.00 | 4864.00 | 8384.00 | 17408.00 | 716416.00 | ▇▁▁▁▁ |

| price | 0 | 1 | 2.28 | 0.65 | 0.52 | 1.79 | 2.17 | 2.73 | 3.87 | ▁▆▇▅▂ |

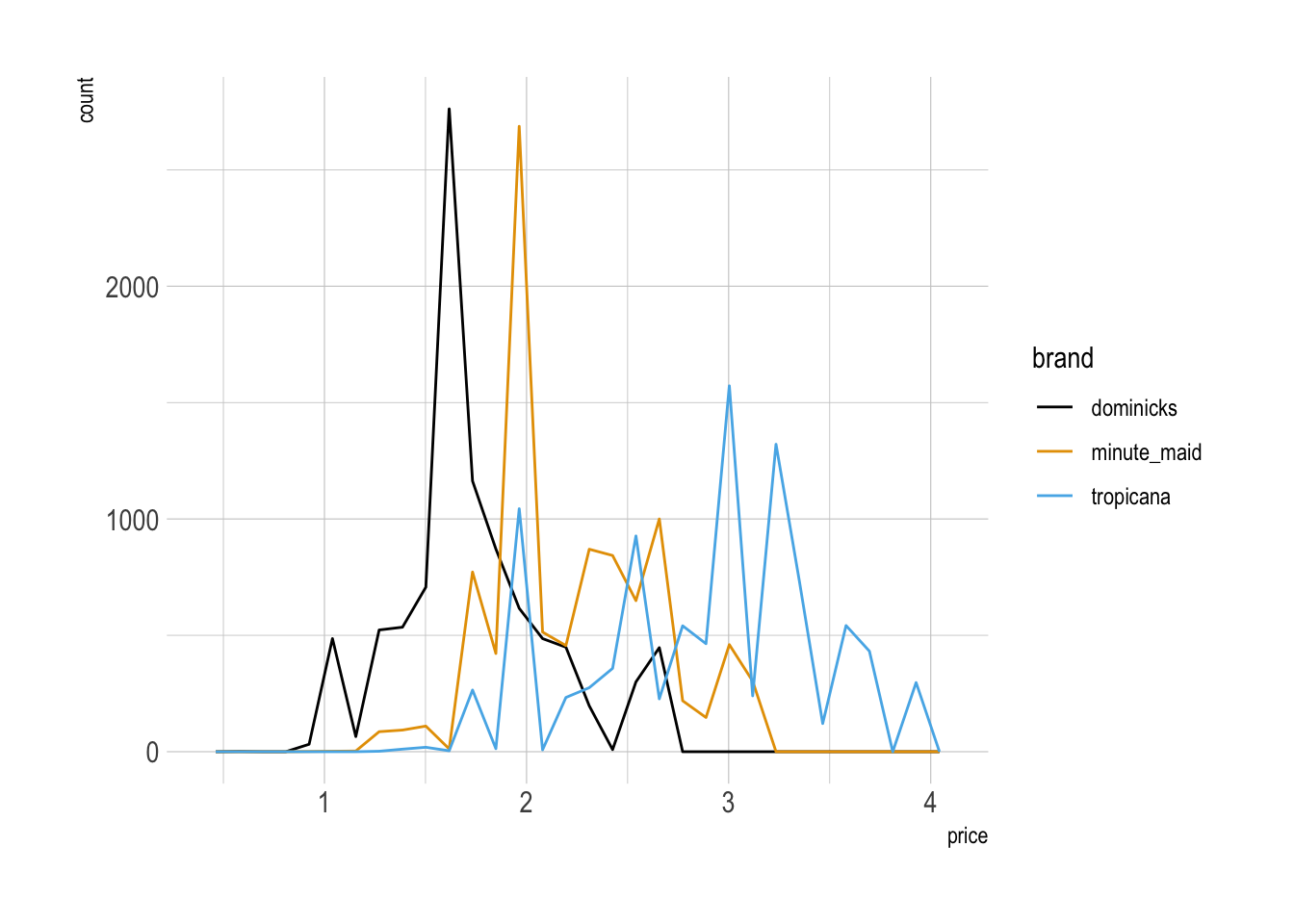

Distribution

df |>

ggplot(aes(x = price, color = brand)) +

geom_freqpoly()

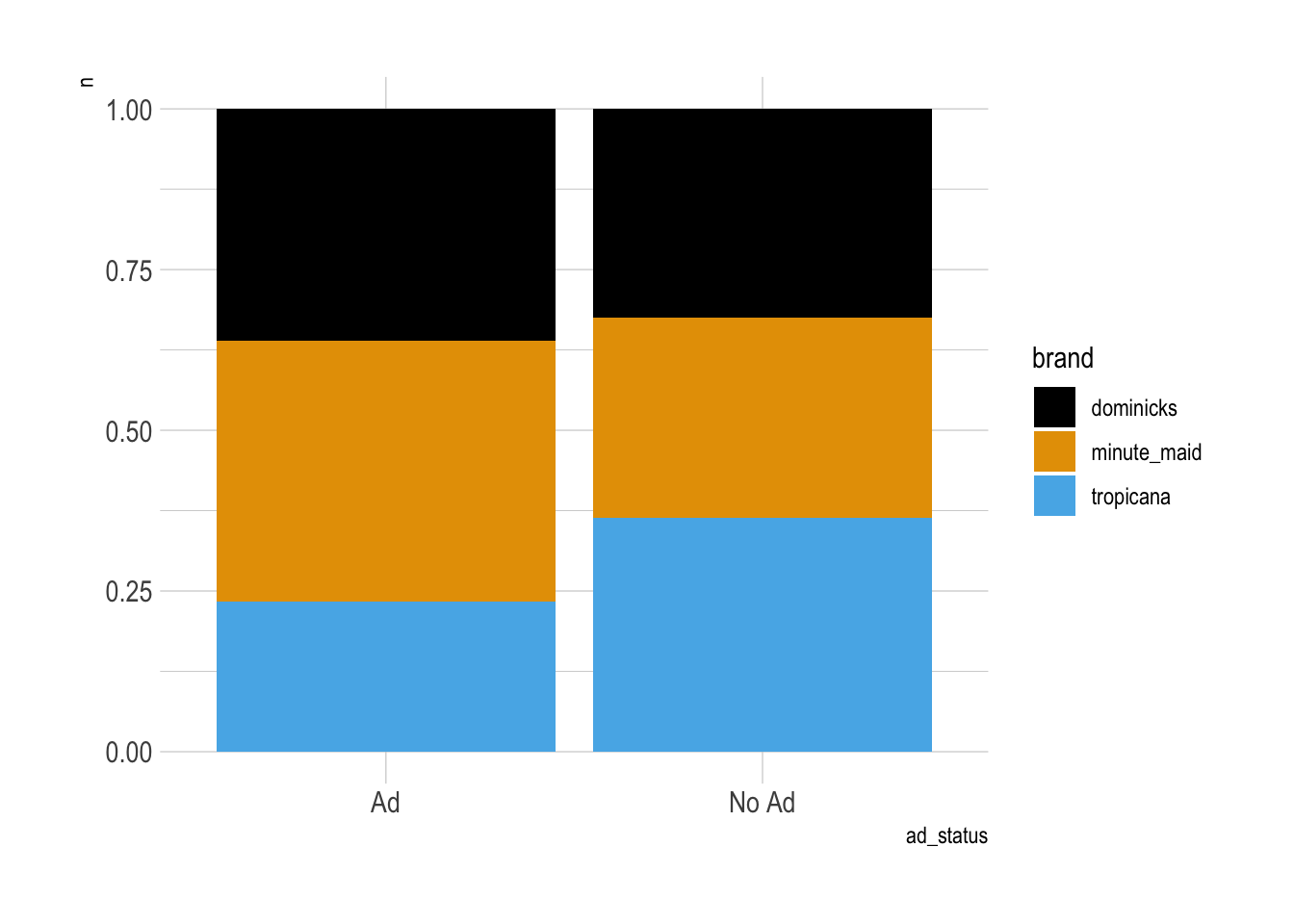

Categorical Variables

df |>

count(brand, ad_status) |>

ggplot() +

geom_col(aes(x = ad_status, y = n,

fill = brand),

position = "fill")

Data Preparation

df <- df |>

mutate(ad_status = factor(ad_status),

ad_status = fct_relevel(ad_status, "No Ad")

)Training and Test Data

set.seed(1)

df <- df |>

mutate(rnd = runif(n()))

dtrain <- df |>

filter(rnd > 0.3)

dtest <- df |>

filter(rnd <= 0.3)

nrow(dtrain) / nrow(df)[1] 0.6971707Models

Model 1

\[ \begin{align} \log(\texttt{sales}_{\texttt{i}}) \,=\, &\quad\;\; b_{\texttt{intercept}} \\ &\,+\,b_{\,\texttt{mm}}\,\texttt{brand}_{\,\texttt{mm}, \texttt{i}} \,+\, b_{\,\texttt{tr}}\,\texttt{brand}_{\,\texttt{tr}, \texttt{i}}\\ &\,+\, b_{\texttt{price}}\,\log(\texttt{price}_{\texttt{i}}) \,+\, e_{\texttt{i}} \end{align} \]

Model 2

\[ \begin{align} \log(\texttt{sales}_{\texttt{i}}) \,=\,&\;\; \quad b_{\texttt{intercept}} \,+\, \color{Green}{b_{\,\texttt{mm}}\,\texttt{brand}_{\,\texttt{mm}, \texttt{i}}} \,+\, \color{Blue}{b_{\,\texttt{tr}}\,\texttt{brand}_{\,\texttt{tr}, \texttt{i}}}\\ &\,+\, b_{\texttt{price}}\,\log(\texttt{price}_{\texttt{i}}) \\ &\, +\, b_{\texttt{price*mm}}\,\log(\texttt{price}_{\texttt{i}})\,\times\,\color{Green} {\texttt{brand}_{\,\texttt{mm}, \texttt{i}}} \\ &\,+\, b_{\texttt{price*tr}}\,\log(\texttt{price}_{\texttt{i}})\,\times\,\color{Blue} {\texttt{brand}_{\,\texttt{tr}, \texttt{i}}} \,+\, e_{\texttt{i}} \end{align} \]

Model 3

\[ \begin{align} \log(\texttt{sales}_{\texttt{i}}) \,=\,\quad\;\;& b_{\texttt{intercept}} \,+\, \color{Green}{b_{\,\texttt{mm}}\,\texttt{brand}_{\,\texttt{mm}, \texttt{i}}} \,+\, \color{Blue}{b_{\,\texttt{tr}}\,\texttt{brand}_{\,\texttt{tr}, \texttt{i}}} \\ &\,+\; b_{\,\texttt{ad}}\,\color{Orange}{\texttt{ad}_{\,\texttt{i}}} \qquad\qquad\qquad\qquad\quad \\ &\,+\, b_{\texttt{mm*ad}}\,\color{Green} {\texttt{brand}_{\,\texttt{mm}, \texttt{i}}}\,\times\, \color{Orange}{\texttt{ad}_{\,\texttt{i}}}\,+\, b_{\texttt{tr*ad}}\,\color{Blue} {\texttt{brand}_{\,\texttt{tr}, \texttt{i}}}\,\times\, \color{Orange}{\texttt{ad}_{\,\texttt{i}}} \\ &\,+\; b_{\texttt{price}}\,\log(\texttt{price}_{\texttt{i}}) \qquad\qquad\qquad\;\;\;\;\, \\ &\,+\, b_{\texttt{price*mm}}\,\log(\texttt{price}_{\texttt{i}})\,\times\,\color{Green} {\texttt{brand}_{\,\texttt{mm}, \texttt{i}}}\qquad\qquad\qquad\;\, \\ &\,+\, b_{\texttt{price*tr}}\,\log(\texttt{price}_{\texttt{i}})\,\times\,\color{Blue} {\texttt{brand}_{\,\texttt{tr}, \texttt{i}}}\qquad\qquad\qquad\;\, \\ & \,+\, b_{\texttt{price*ad}}\,\log(\texttt{price}_{\texttt{i}})\,\times\,\color{Orange}{\texttt{ad}_{\,\texttt{i}}}\qquad\qquad\qquad\;\;\, \\ &\,+\, b_{\texttt{price*mm*ad}}\,\log(\texttt{price}_{\texttt{i}}) \,\times\,\,\color{Green} {\texttt{brand}_{\,\texttt{mm}, \texttt{i}}}\,\times\, \color{Orange}{\texttt{ad}_{\,\texttt{i}}} \\ &\,+\, b_{\texttt{price*tr*ad}}\,\log(\texttt{price}_{\texttt{i}}) \,\times\,\,\color{Blue} {\texttt{brand}_{\,\texttt{tr}, \texttt{i}}}\,\times\, \color{Orange}{\texttt{ad}_{\,\texttt{i}}} \,+\, e_{\texttt{i}} \end{align} \]

Training the Models

m1 <- lm(log(sales) ~ brand + log(price),

data = dtrain)

m2 <- lm(log(sales) ~ brand * log(price),

data = dtrain)

m3 <- lm(log(sales) ~ brand * ad_status * log(price),

data = dtrain)Regression Table with stargazer()

stargazer(m1, m2, m3,

type = "html")| Dependent variable: | |||

| log(sales) | |||

| (1) | (2) | (3) | |

| brandminute_maid | 0.868*** | 0.908*** | 0.027 |

| (0.015) | (0.050) | (0.056) | |

| brandtropicana | 1.527*** | 0.918*** | 0.696*** |

| (0.019) | (0.055) | (0.060) | |

| ad_statusAd | 1.091*** | ||

| (0.045) | |||

| log(price) | -3.149*** | -3.396*** | -2.795*** |

| (0.027) | (0.043) | (0.046) | |

| brandminute_maid:ad_statusAd | 1.200*** | ||

| (0.097) | |||

| brandtropicana:ad_statusAd | 0.753*** | ||

| (0.118) | |||

| brandminute_maid:log(price) | 0.032 | 0.806*** | |

| (0.068) | (0.074) | ||

| brandtropicana:log(price) | 0.710*** | 0.756*** | |

| (0.064) | (0.068) | ||

| ad_statusAd:log(price) | -0.511*** | ||

| (0.087) | |||

| brandminute_maid:ad_statusAd:log(price) | -1.099*** | ||

| (0.144) | |||

| brandtropicana:ad_statusAd:log(price) | -0.924*** | ||

| (0.149) | |||

| Constant | 10.837*** | 10.967*** | 10.418*** |

| (0.017) | (0.025) | (0.028) | |

| Observations | 20,181 | 20,181 | 20,181 |

| R2 | 0.399 | 0.403 | 0.537 |

| Adjusted R2 | 0.399 | 0.403 | 0.537 |

| Residual Std. Error | 0.795 (df = 20177) | 0.792 (df = 20175) | 0.697 (df = 20169) |

| F Statistic | 4,463.077*** (df = 3; 20177) | 2,726.510*** (df = 5; 20175) | 2,128.289*** (df = 11; 20169) |

| Note: | p<0.1; p<0.05; p<0.01 | ||

Beta Estimates with tidy()

m1_betas <- tidy(m1, conf.int = T)

m2_betas <- tidy(m2, conf.int = T)

m3_betas <- tidy(m3, conf.int = T)Prediction with predict()

dtest <- dtest |>

mutate(

pred_1 = predict(m1, newdata = dtest),

pred_2 = predict(m2, newdata = dtest),

pred_3 = predict(m3, newdata = dtest)

)Prediction with augment()

m1_pred_train <- augment(m1)

m1_pred_test <- augment(m1, newdata = dtest)

m2_pred_train <- augment(m2)

m2_pred_test <- augment(m2, newdata = dtest)

m3_pred_train <- augment(m3)

m3_pred_test <- augment(m3, newdata = dtest)Various Model Statistics with glance()

m1_r2 <- glance(m1)

m2_r2 <- glance(m2)

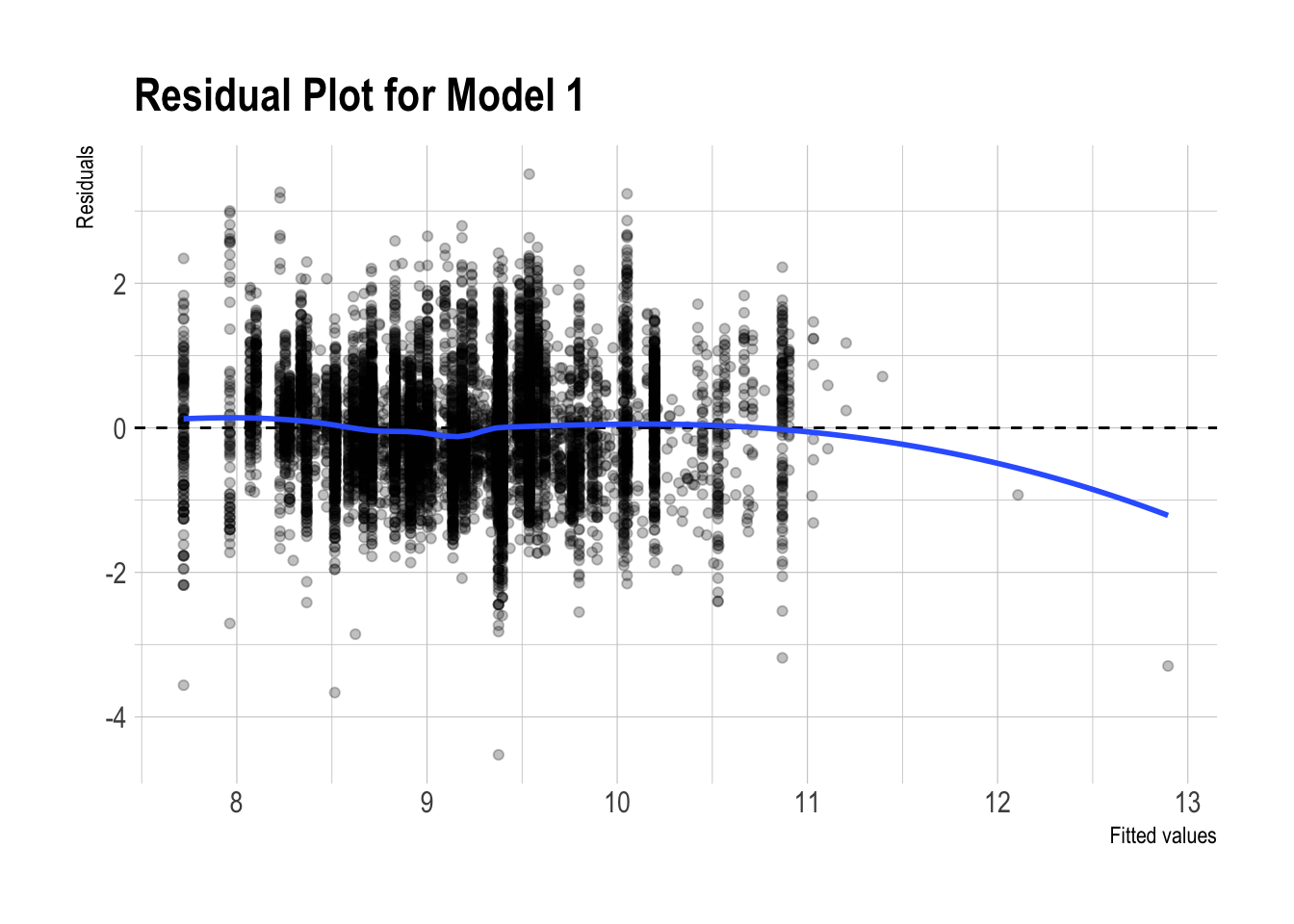

m3_r2 <- glance(m3)Residual Plots

m1_pred_test |>

ggplot(aes(x = .fitted, y = .resid)) +

geom_point(alpha = 0.25) +

geom_hline(yintercept = 0, linetype = "dashed") +

geom_smooth(se = FALSE, method = "loess") +

labs(

x = "Fitted values",

y = "Residuals",

title = "Residual Plot for Model 1"

)

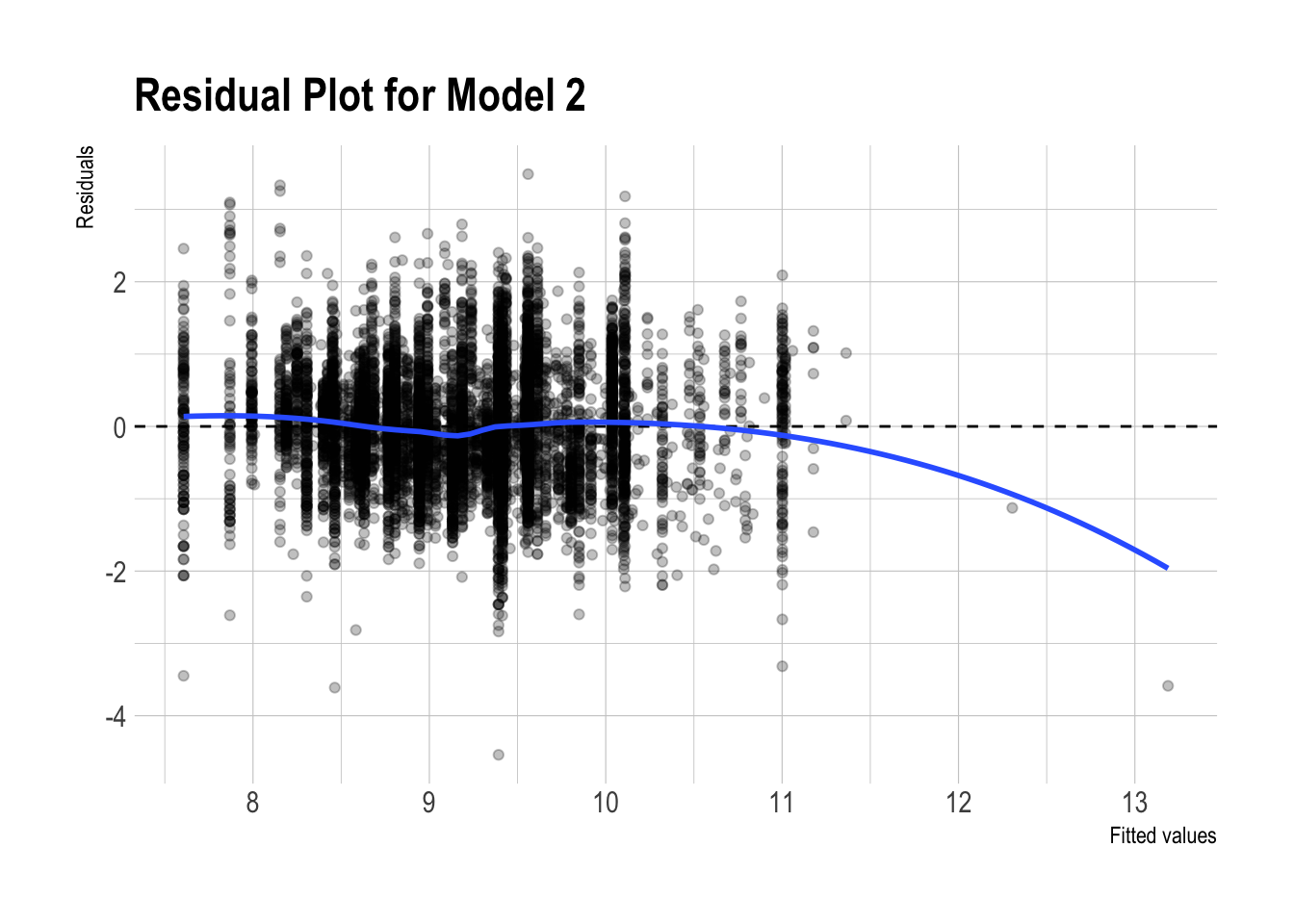

m2_pred_test |>

ggplot(aes(x = .fitted, y = .resid)) +

geom_point(alpha = 0.25) +

geom_hline(yintercept = 0, linetype = "dashed") +

geom_smooth(se = FALSE, method = "loess") +

labs(

x = "Fitted values",

y = "Residuals",

title = "Residual Plot for Model 2"

)

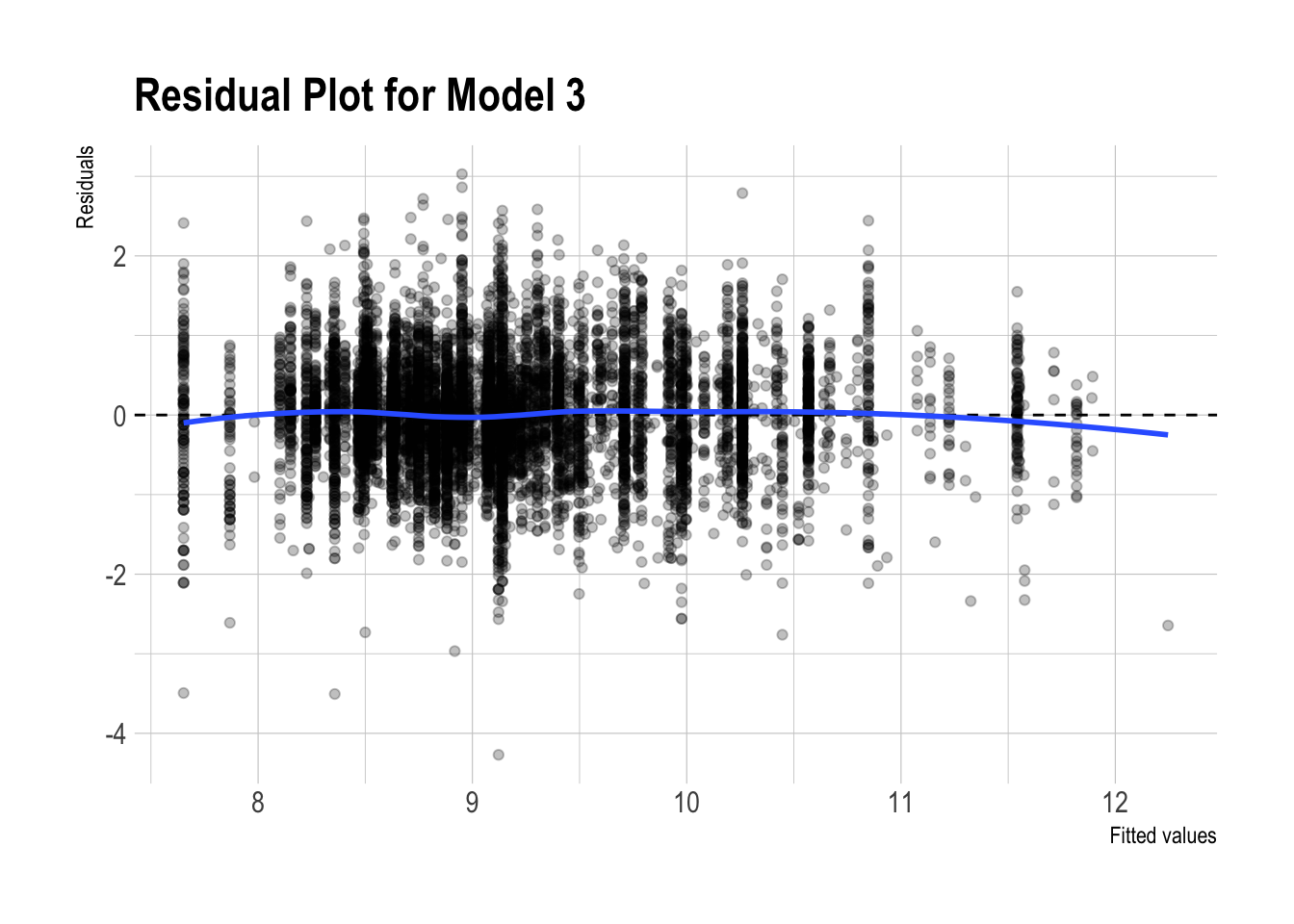

m3_pred_test |>

ggplot(aes(x = .fitted, y = .resid)) +

geom_point(alpha = 0.25) +

geom_hline(yintercept = 0, linetype = "dashed") +

geom_smooth(se = FALSE, method = "loess") +

labs(

x = "Fitted values",

y = "Residuals",

title = "Residual Plot for Model 3"

)

RMSEs

RMSEs <- dtest |>

mutate(

resid_1 = log(sales) - pred_1,

resid_2 = log(sales) - pred_2,

resid_3 = log(sales) - pred_3

) |>

summarize(

rmse_1 = sqrt( mean( resid_1^2 ) ),

rmse_2 = sqrt( mean( resid_2^2 ) ),

rmse_3 = sqrt( mean( resid_3^2 ) )

)

RMSEs# A tibble: 1 × 3

rmse_1 rmse_2 rmse_3

<dbl> <dbl> <dbl>

1 0.791 0.790 0.690