library(tidyverse)

library(stargazer)

library(broom)Homework 1

Linear Regression · Quarto Blogging

Directions

Submit your Quarto document for Part 1 to Brightspace using this filename format:

danl-320-hw1-LASTNAME-FIRSTNAME.qmd

(e.g.,danl-320-hw1-choe-byeonghak.qmd)

Due: February 11, 2026, 3:15 PM (ET)

Questions? Email Byeong-Hak bchoe@geneseo.edu.

Required R Packages

Part 1. Linear Regression

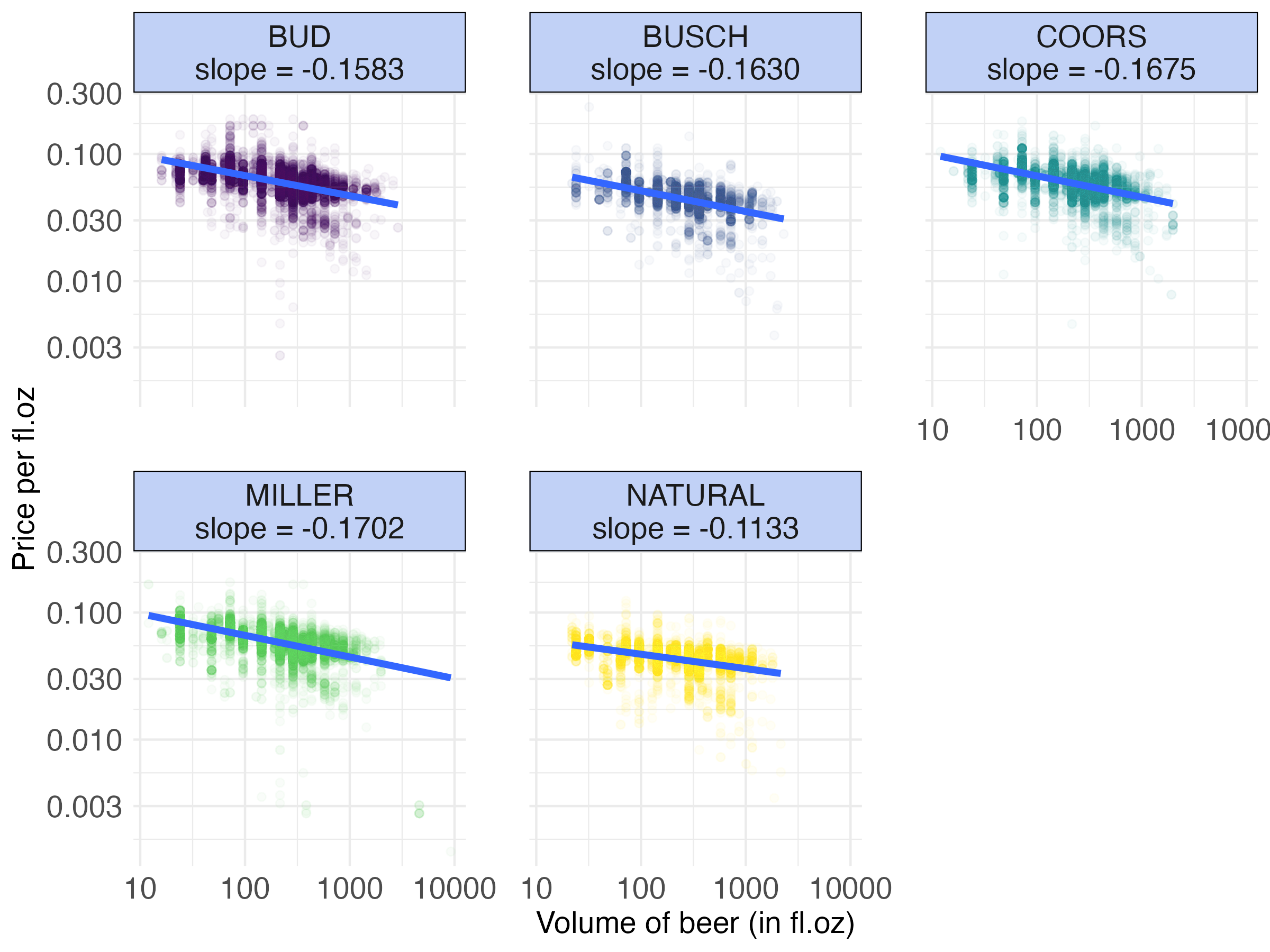

Consider the beer_markets data:

library(tidyverse)

beer_markets <- read_csv(

"https://bcdanl.github.io/data/beer_markets_all_cleaned.csv"

)